Compound Int. Calc

Compound Int. Calc + Monthly Increase (P.M.)

Compound Int. Calc + Monthly Increase (P.A.)

Must-Read Books

Compound Int. Calc

Compound Int. Calc + Monthly Increase (P.M.)

Compound Int. Calc + Monthly Increase (P.A.)

Must-Read Books

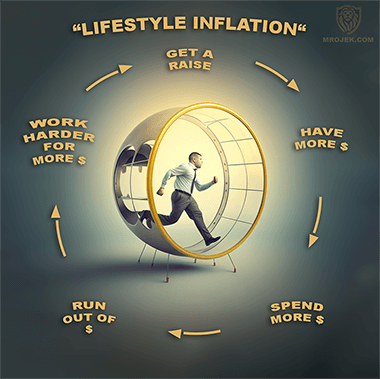

Lifestyle inflation, also known as lifestyle creep, is a phenomenon that occurs when an individual's expenses increase in proportion to their income. This can lead to a cycle of spending more and more money on luxury items and experiences, while savings and investments are neglected.

The concept of lifestyle inflation is simple: as people earn more money, they tend to spend more money. This is often seen as a natural progression in life, as people work their way up the career ladder and earn more money. However, this increase in spending can quickly spiral out of control and lead to financial stress and difficulty in achieving long-term financial goals.

One of the main reasons lifestyle inflation occurs is because people tend to compare themselves to others. They see their friends and colleagues buying luxury cars, designer clothes, and taking expensive vacations, and feel that they should be able to do the same. However, this kind of comparison is misleading and can lead to overspending and neglecting saving and investing.

Another important concept to keep in mind is the power of compounding. By investing and saving a portion of your income, you are taking advantage of the power of compounding, where your money earns interest on top of interest over time. The longer your money is invested, the greater the potential for growth. To see the potential growth of your investment, you can use a COMPOUND INTEREST CALCULATOR WITH MONTHLY CONTRIBUTION (COMPOUNDED MONTHLY).

The key to avoiding lifestyle inflation is to be mindful of your spending and to set clear financial goals. Here are some tips to help you avoid falling victim to lifestyle inflation:

Lifestyle inflation can be a difficult habit to break, but by being mindful of your spending and setting clear financial goals, you can avoid falling victim to it and take control of your financial future.

Lifestyle inflation can be a trap that many people fall into, but it doesn’t have to be that way. By understanding the concept of lifestyle inflation and being mindful of your spending habits, you can avoid falling victim to it. Create a budget, save and invest, and focus on your own financial goals to take control of your financial future. Remember, the power of compounding can help you grow your wealth over time, and you can use a COMPOUND INTEREST CALCULATOR WITH MONTHLY CONTRIBUTION (COMPOUNDED YEARLY) to see the potential growth of your investment.